This is a special edition of 5x5 Crypto News. I hope you enjoy it. As always I welcome your feedback.

They say curiosity killed the cat. Fortunately, I’m not a feline. Ha! Jokes aside, my mind is frequently buzzing with questions. Lately, I have been thinking about the future of cryptocurrency exchanges. Why do people choose certain exchanges but not others? Would consumers be happy to access cryptocurrencies through banks? I conducted a survey to answer these and other questions.

Here are the key takeaways from my survey:

Consumers want investment accounts: ~80% of surveyed consumers see cryptocurrencies as strategic investments. 50% of consumers would like to purchase cryptocurrencies through investment accounts like Fidelity or Vanguard.

Consumers are promiscuous: Trust, cost and ease of use are the most important factors when selecting a cryptocurrency exchange. Customers are kinda promiscuous: 46% of surveyed consumers are very likely to change to a provider who provided superior performance in their key buying factors.

So what does this mean?

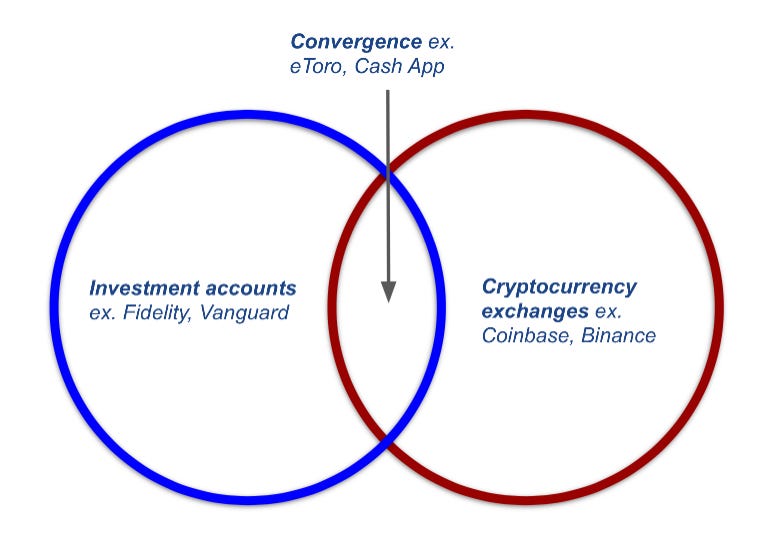

Consumers value convenience. They have limited funds to invest and are evaluating both stocks and cryptocurrencies. If this holds true, then should we not see cryptocurrency exchanges and investment accounts converge?

But it won’t look the same. One of the hallmarks of cryptocurrencies is 24x7x365 access to trade. In contrast, the stock market is closed more hours than it is open each week. Binance has started tokenizing select stocks likes Tesla enabling them to be traded around the clock. We live in a 24-hours news cycle with 24-hour gyms and grocery stores. The 40-hour a week stock market feels like a relic of yesteryear. If regulators are supportive, one could imagine consumers embracing this opportunity.

Not just an investment. The predominant narrative is ‘Bitcoin is a store of value like digital gold’. It makes sense that surveyed consumers would prefer to access it through their investment accounts. But that’s not all. There are also opportunities to earn high interest rates by staking. Digital currencies could also support cheaper and faster payments. There’s more. Perhaps established players will adopt crypto solutions aligned with their mission. For example, banks might engage with digital currencies to enable cheaper and faster payments.

Survey results

Why do you buy cryptocurrencies?

~80% of surveyed consumers buy and hold cryptocurrencies as strategic investments; they most frequently buy them monthly

This could evolve as digital currencies are used for payments especially remittances

What would be your ideal way to purchase cryptocurrencies?

Almost 50% of surveyed consumers would prefer to purchase cryptocurrencies via investment accounts ex Vanguard, Fidelity

27% of participants would prefer to use bank accounts or cryptocurrency exchanges. This suggests that banks have an opportunity to provide additional services to customers.

Interestingly, none of the participant listed digital wallets ex Apple Pay or FinTech solutions ex CashApp as an ideal solution. I think this might to speak to the more established trust participants have with banks, investments and crypto exchanges. Results may differ with a larger sample size.

What are top 3 most important factors when selecting a crypto exchange?

Trust, cost, and appearance are the 3 most important factors when selecting a cryptocurrency exchange

Trust is difficult to build but easy to lose. Banks and investment firms have established trust with their existing customers. They could extend new services to their customers. However, crypto exchanges need to intentionally build trust.

Large players like Coinbase have outsize name recognition which helps engender trust. I’m curious to see if there will be consolidation of native crypto exchanges

How willing are you to change to another provider that has superior performance in the most important factors?

46% of surveyed consumers are likely to change to another product if it provided superior performance in the features most important to them

This suggests that we are still in the early days

Conclusions

There is an opportunity for banks and investment managers to enable their customers to access cryptocurrencies. The majority of consumers are strategic investors, however, high frequency traders are likely to drive the majority of revenues.

Trust, cost, and appearance are the most important factors when selecting a product to access cryptocurrencies. However, almost half of surveyed consumers are willing to change to a provider that provides superior performance.

Share this post