If you are like me, then you were a little awkward in college. Here’s an example of an interaction I had on campus as I walked from my dorm to class.

Pretty college co-ed: “Hey! Do you want a free t-shirt?”

Me: Uh! (Awkwardly looks away. Runs in the opposite direction.)

Don’t hurt me🤕

It’s complicated.

Let’s flash back a few months before this awkward interaction.

So many thoughts rushed through my head as I packed my bags. I wondered if my American professors would understand my Nigerian accent. I wondered if I would easily make friends, maybe meet a nice girl. But then my mother rocked me back to earth as she exclaimed “Please stay away from credit cards o!”. Apparently, someone’s son was drowning in credit card debt. I guess he thought the money was free.

In Nigeria, less than 3% of consumers have access to credit. It’s a stark contrast to the US, where 83% of adults have credit cards (Federal Reserve). My mum’s friend’s son had recently relocated from Nigeria to the US for college. He was woefully unaware of how to manage credit. He would stop and chat with the pretty college co-eds waving free t-shirts in front of the gym. Eventually, he signed up for a couple of credit cards. Then it all went downhill. He didn’t stand a chance.

And so I stayed away from credit cards.

The case for credit 💳

But my views have evolved. I no longer see credit as a tool for self-destruction. Rather, I see credit as a tool - it’s neither good nor bad - it’s just a tool. If used properly, credit could help people build wealth and live healthier and happier lives. But if used improperly, it could lead to financial ruin. Credit is a double-edged sword.

Living in Nigeria meant you paid cash for everything. The words “mortgage”, “car loan”, “student debt” and “credit card bills” were not in our vocabulary. No one had credit! And so you paid 100% cash when you bought a house or a car. The lack of credit also meant that no one had a credit score. So if you wanted to rent an apartment, you would have to pay 1-2 years of rent upfront. Needless to say, many of my cousins lived with their parents well into their late 20s and early 30s.

Can you imagine if the US had the same setup as Nigeria? There would be untold pain. According to the National Association of Realtors, the average new home buyer in the US paid just 7% of the total purchase price as a downpayment and took out a loan for the rest. Similarly, according to Statista, 85% of new car purchases in the US are financed. Collectively, Americans owe more than $1.2 trillion in car loans. In Nigeria, the total is closer to $0.

The ability to thoughtfully take on credit could save lives. Many hospitals in Nigeria require full payment before treatment is rendered. Too many people have needlessly died while family members frantically rushed to raise funds to pay for life-saving treatment. It’s desperately heart-wrenching.

The ability to take on mortgages could help many families own their homes and start building multi-generational wealth. Construction loans also enable investors to deliver more housing units to eager customers.

Access to credit could enable a business owner to grow and sustain their business. Businesses might need loans to purchase raw materials to fulfill large orders. Businesses could even offer credit to customers, enabling them to buy more products. Credit could provide the runway a growing entrepreneur needs to take off.

The list could go on. The bottom line is that access to credit could help grow the economy while enabling people and businesses to lead more prosperous lives. If this is true, then why do only 3% of Nigerians have access to credit?

Problems dey 🚧

My sense is that credit penetration is low for a couple of key reasons:

Structural: Nigeria does not have a well-established credit score system. In other countries, credit scores are linked to a national identity number ex Social Security Number. In recent years, Nigeria introduced a National Identification Number. This is a key first step.

Enforcement: Nigeria experiences weak enforcement of justice, that’s putting it nicely. This means that creditors are highly exposed if the debtor does not pay. I’ve heard of judges being bribed, police turning a blind eye, and uneven treatment. Creditors may not reliably have recourse for bad loans.

Other business: Given the aforementioned risks, historically Nigerian banks considered other business opportunities to be more lucrative than lending. Providing credit to the masses was not high on their priority list. Fortunately, in recent years Nigerian banks have started offering secure credit cards backed up by deposits to their customers.

Policy: Government policy does not expressly encourage the extension of credit to the masses. Incentives, if any, do not appear to be working.

Nonetheless, there are many exciting FinTechs working to crack this nut. I recently met a couple of them at a FinTech Happy Hour in NYC.

Local solutions to local problems 👷

QuickCheck is one of the exciting FinTechs extending credit to Nigerians through a mobile app. The start-up was founded in 2017. It uses artificial intelligence and machine learning to extend microloans to its customers. Quickcheck’s lending process is very fast (less than 10 min) and does not require any paper documents.

Quickcheck has funded over 1.1 million micro-loans averaging $80 for 30-day terms. The total value of loans disbursed exceeds $40M. Most of the customers are middle class and 80% are between 25 and 43 years old. Returning customers account for over 70% of loans provided each month. The average interest charged is 40-50% per annum but bear in mind that most loans are only for 1 month-long term. Customers often use the loans to cover emergency expenses, school fees, or business expenses.

QuickCheck works like a middle-man. They borrow large chunks of money at lower interest rates from high-net-worth individuals (HNWI) and institutions, then they turn around and lend out small chunks of money at higher interest rates to individuals and small-medium-sized businesses. They profit from the difference between interest rates, however, they also take the risk of issuing bad loans and the cost of operations.

Figure 1: This is an illustration of QuickCheck’s business model

QuickCheck needs to borrow more money so that it can grow its lending business and extend its impact. Unfortunately, it finds itself in an underserved in-between class of small- and middle-sized enterprises. Typically, businesses that need to raise less than $100k can access funds from local high-net-worth individuals (HNWI) or the capital markets. Larger businesses seeking to raise more than $5M can often access institutional creditors. But Quickcheck’s needs are in between these extremes.

DeFi to the rescue? 💻

Decentralized Finance (DeFi) seeks to reduce costs and increase efficiency by using smart contracts and blockchain technology to eliminate middlemen like banks.

For instance, today if you wanted to borrow $100k to buy a house, you might go to Bank of America. They will assess your creditworthiness and determine what interest rate to offer you. Mind you, Bank of America has thousands of employees and expensive offices all around the country. Thus, the interest rate they offer you need to be high enough for them to offset their costs and deliver a profit to their shareholders. Additionally, the United States has a recent history of bias in lending. Several banks, most notably Wells Fargo, have admitted that some under-represented minority groups were unfairly charged higher interest rates than others with similar qualifications. DeFi could help fix this.

DeFi relies on smart contracts. This helps remove bias. Smart contracts are computer code. They simply operate based on data. If a person wanted to borrow $100k, the smart contract might check to determine if certain qualifications are met, if true then it disburses a loan. And because DeFi applications don’t have thousands of employees or expensive offices, they could offer more competitive interest rates than traditional lenders.

Today, much of DeFi relies on over-collateralization to issue loans. Thus, if you wanted to borrow $100k cash you might be required to provide $150k of bitcoin which is held as collateral while you repay the loan. Overcollateralization works for crypto-rich, cash-poor people who believe that the value of digital assets would rise in the future. However, it does not work for the under-banked or those who do not have significant a pile of digital assets. DeFi needs to extend beyond over-collateralization in order for it to achieve more impact. There are a number of exciting Crypto projects working on this.

Meet Goldfinch 🐦

Goldfinch has provided QuickCheck with $1.45M debt since January 2020.

Goldfinch is a decentralized protocol that allows for borrowing without crypto collateral. It is focused on reaching underserved emerging markets in Africa, South America, and Asia. In January 2022, Goldfinch raised $25M in funding from Andreessen Horowitz, Coinbase Ventures, SV Angel, Bill Ackman, and others. The startup previously raised $11M in June 2021.

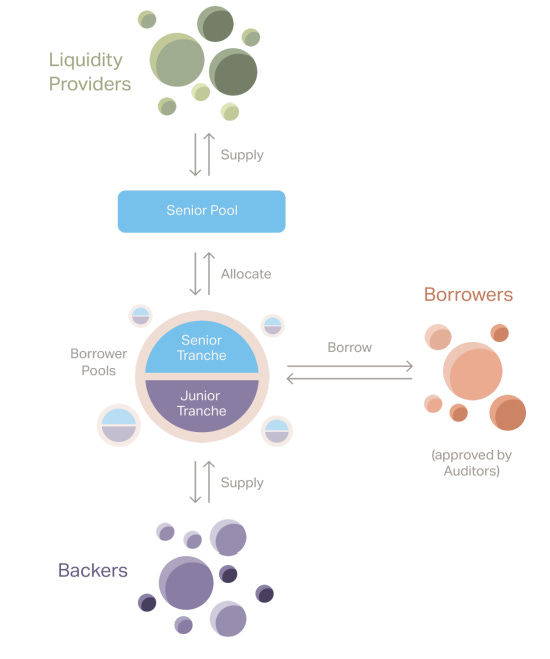

Goldfinch works by the interplay of four types of protocol participants:

Borrowers: Small- and medium-sized businesses seeking to borrow funds. Borrower Pools list the loan terms the Borrower seeks ex. interest rate, amount, and loan term. Borrowers typically request funds in USDC, the stablecoin backed 1:1 with US dollars.

Backers: Backers assess the Borrower Pools and determine whether they should provide first-loss capital. First-loss capital means that the Backers are eligible to receive a higher return on the loan than other capital providers but if the Borrower defaults, the Backers will be the first not to get paid.

Liquidity Providers (LP): LPs provide the senior line of credit to earn passive yield. They don’t have to actively assess every proposed Borrower. Rather, LP funds are invested if there is a sufficient level of commitment from Backers. When LPs provide senior credit, a portion of their interest is redirected to Backers to incentivize Backers to properly assess Borrowers.

Auditors: Auditors vote to approve Borrowers. They provide a human-level check to guard against fraud. Auditors are randomly

Figure 2: Illustration of the Goldfinch protocol

Once a loan has been issued, Borrowers make repayments to the Borrower Pool based on the interest rate and payment period. When the Borrowers pay more than the interest owed, the remainder is applied to the principal balance.

The Borrower Pools have a Senior Tranche and a Junior Tranche. LPs provide funds for the Senior Tranche while Backers supply to the Junior Tranche. When the Borrower repays, the Borrower Pool first applies the funds to interest and principal owed to the Senior Tranche at that time, and the remaining funds are then applied to the Junior Tranche’s interest and principal balance.

Backers and LPs receive an NFT when they initially supply capital. The NFT tracks the amount that was supplied and the amount that is still outstanding. NFTs ensure that no one can redeem more than their proportional share of the total repayments as they come in. For instance, if two Backers each supplied $1,000 for a total of $2,000 borrowed, and the Borrower has only paid back $400 thus far, the NFTs ensure that each Backer can only redeem up to $200, which is their portion of the repayments thus far, rather than each Backer racing to redeem the full $400 themselves.

For more information on Goldfinch and how the protocol is structured and participants incentivized, please check out their white paper.

Closing thoughts 💭

There is a tremendous and growing market for credit, especially in emerging markets like Nigeria. It is exciting to see crypto solutions like Goldfinch tackle this problem. But Nigeria has over 200 million people. Goldfinch is still a drop in the ocean of opportunity. Fortunately, technology does not scale linearly. Adoption could grow exponentially. I believe the market is big enough for many more players to emerge.

Share this post