Each week, I cover the “So what?” of 5 key crypto stories. Let’s go.

India Proposes Crypto Ban

BJP, India’s ruling party, has proposed a ban on private cryptocurrencies in favor of developing a national digital currency

So what?

My first question is why can’t they coexist? What’s the trigger? My sense is that some government officials have two fears - the first is cryptocurrencies will be be used by criminals and the second is that the central bank may lose some control if a significant portion of the economy moved on chain

And so...with the flick of a pen, an outright ban would exclude almost 20% of the world’s population from participating in private digital currencies. It could set the precedent for more nations to follow suit.

That said, while the ban would discourage interest, it might prove difficult to fully enforce. India already has 5-7 million citizens who own cryptocurrencies.

OKCoin launches blockchain domain name

OKCoin became the first digital currency exchange to to offer blockchain domain names by partnering with Unstoppable Domains

So what?

If you have ever had the nerve racking, heart thumping experience of transferring a large amount of cryptocurrency between wallets then you can relate. One of the steps involves copying and pasting the wallet address which is a super long mix of letters and numbers into a field. If one character is missing or off, then you risk sending your crypto to the wrong address and there is basically low to no chance of a refund.

But wait - there’s a fix for that. I’m excited about the ability to use a blockchain domain name like David101 instead of that super long mix of random letters and numbers.

I think this a great step in improving user experience and making this space more palatable for mainstream consumers who are used to seamless experiences with Apple and CashApp

I expect other wallets and digital currency exchanges will join the party.

Visa to integrate crypto

Visa is partnering with wallets and exchanges to enable users to purchase these currencies using their Visa credentials or to cash out onto their Visa credential to make a fiat purchase at any of the 70 million merchants where Visa is accepted globally

So what?

Visa is positioning itself to continue to be a payments player irrespective of the technology used

Visa has been active in the crypto space. Visa has partnered with 35 digital currency exchanges and platforms such as Fold and BlockFi to issue Visa cards. These partnerships have potential for 50 million Visa credentials.

Visa is a leading payment system in the West. This could encourage traditional banks to move towards holding deposits of digital currencies and supporting transactions.

Coinbase to direct list IPO

The direct listing is expected to occur late February to early March

So what?

Coinbase says it is proceeding with a direct listing because it more closely aligns with the crypto ethos of access for all. I don’t think it hurts that this allows the company to avoid a ton of investment banking fees

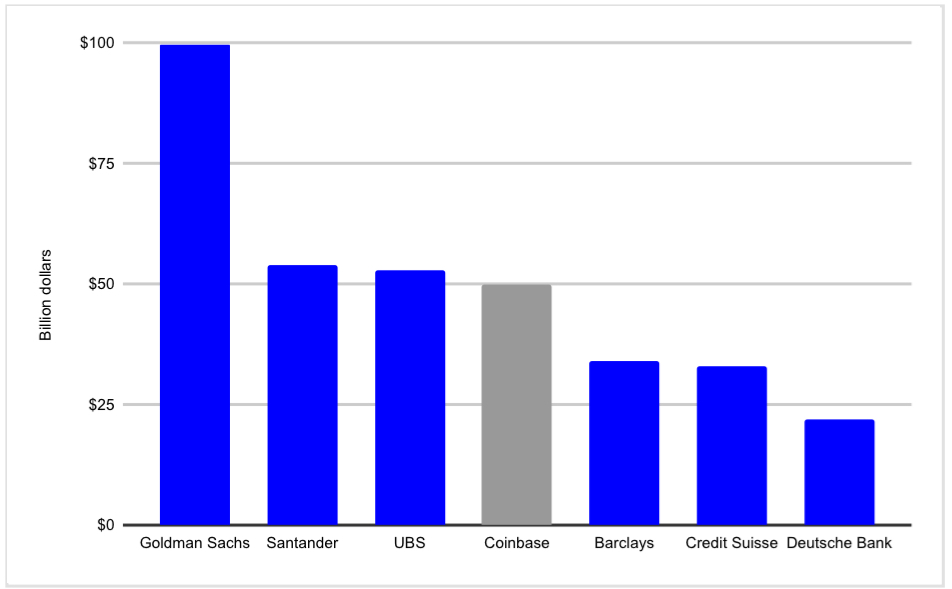

Now, Coinbase shares are reportedly trading around $200 a pop on the secondary market. This implies a valuation of around $50B, which would make it larger than Credit Suisse and Deutsche Bank.

The stock market has been pretty exuberant lately. I am excited to see this thing pop.

Miami wants to lead blockchain

Mayor Saurez aims to position Miami as a hub for blockchain innovation and “the most crypto competitive city on the planet”

He appointed Saif Ishoof as the city’s first Chief Technical Officer to provide “concierge services” to the industry

So what?

Much has been written about California’s “tech exodus”, irrespective of your position, it’s clear that other cities and states are rolling out the red carpet

I don’t think Miami is trying to dethrone Silicon Valley but perhaps it could become the Charlotte-Raleigh-Durham banking equivalent for crypto

Miami’s ties to the Caribbean and Latin America suggests some locals may already have exposure to digital currencies for cross-border transfers and and trade

The city could become a pioneer and a testing lab for new initiatives like paying property taxes in digital currency, holding part of the city’s cash reserves in digital currency….and so on. These symbolic moves could strengthen its reputation and help attract more entrepreneurs and VCs to the ecosystem.

Share this post