Hey y’all!

Today we are doing a special edition exploring the opportunity for crypto in the developing world. This is a topic close to my heart as I was born in Nigeria. I have been fortunate to have lived and worked in Africa, Europe and North America. This has given me a perspective on how different and similar we all are. When it comes down to it, people want to create a good life for themselves and their families. However, situations vary greatly within and across countries. This brings me to this question:

Can crypto and DeFi (decentralized finance) enable economic prosperity?

Join me as I explore. As always, please let me know what your thoughts are. I am always happy to engage. Thanks!

Banking the other half

He quietly walks in at 4pm everyday. Baba Alajo (“man of the accounts”) is dressed in a white kaftan with a dusty wooden walking-stick in hand. Some say, the walking stick is meant to beat off any would-be pickpockets. You see Baba Alajo is here to pick up cash from my grandmother’s roadside store. He is the closest thing to a bank in this community.

The World Bank estimates that 1.7 billion people are unbanked. These folks do not have access to potentially life enhancing services like low-interest lines of credit for their businesses or a mortgage to buy a home. Instead, many of these people rely on the likes of Baba Alajo to provide them with cash deposit and withdrawal services. They are also particularly vulnerable to predatory loan sharks.

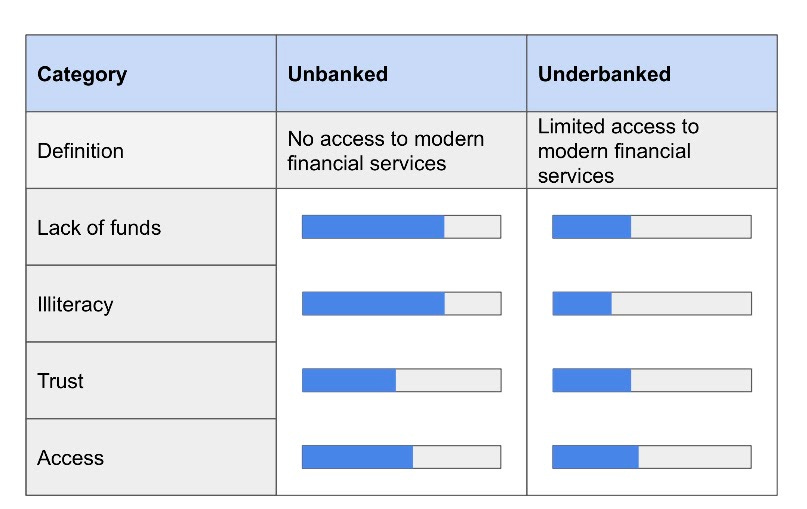

There are 4 key reasons why people do not engage with the formal financial sector.

Lack of funds: According to the World Bank, 59% of unbanked people said lack of funds was the reason they did not have a bank account. Small business owners like my grandma might only earn a couple dollars a day. I once learned about a Ugandan bank that charged customers whenever they received deposits. Ouch! This would eat into the already meagre savings.

Illiteracy: UNESCO reports that over 770 million adults cannot read and write. Women are over-represented in this group. Most banks and FinTechs are designed to serve literate customers. My grandma did not have the opportunity to get a formal education. When she was in her 70s she took an adult reading class at her local church. Many people can’t read, we need to also have solutions to onboard them too.

Trust: Some people have been traumatized by the banking system. As a kid in Nigeria, I remember outcries when banks failed and families lost their life savings. In contrast, people like Baba Alajo are part of the communities they serve. In my grandma’s case, she knew his family and he learned the rhythms of her business. Often times, people like Baba Alajo would pass on their business to their child when they retired. Trust has been built over generations.

Access: Mobile phones have enabled billions of people to participate in modern banking by expanding access to the internet. However, the UN estimates only 47% of people in the developing world have access to the internet. Technology alone can’t close this gap. Trusted community members like my grandma could host mobile phones for shared access. More innovation is required to close this gap at the last mile.

Lack of funds is the primary reason people do not bank. However, my sense is that the unbanked and underbanked have varying exposure to the drivers. I would guess that the underbanked are more literate than the unbanked. They may also have higher trust in financial institutions and greater access to them than the unbanked.

Figure 1. Illustration of the differences between the unbanked and the underbanked

Now that we have established why some people don’t engage with the modern financial sector. Let’s explore what problems they have that could be solved. I’m highlighting three.

Store of value.

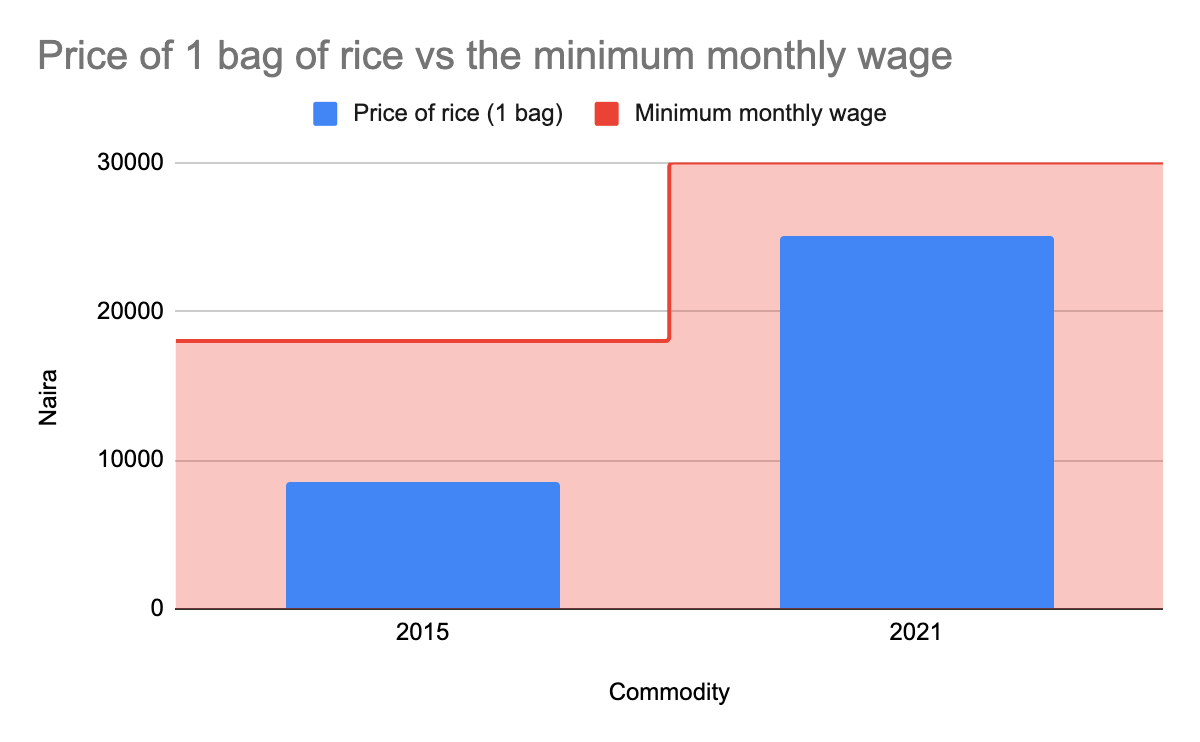

Situation/Complication: Most of the unbanked live in countries facing high levels of inflation and currency devaluation. For instance, in Nigeria, the price of rice has tripled over the past 6 years. During that time period, salaries have not kept up and unemployment worsened. Meanwhile, the nairas’ value has tumbled over the past 6 years from $1 = N200 (2015) to $1=N500 (2021). Consumers who are earning and saving in naira are fighting a losing battle with inflation.

Resolution: One solution is to save in alternative currencies such as US dollars, fiat-backed stablecoins ex. USDC or cryptocurrencies like Bitcoin. Access to dollar denominated accounts is limited in Nigeria but dollar-backed stablecoins paired with high interest savings accounts such as BlockFi or yield farming on Compound could provide a wall of defense against the rising tide of inflation.

Access to credit

Situation/Complication: Access to credit is notoriously limited in some developing countries. There are difficulties enforcing contractual breaches and credit scores are generally not available. The bank lending rate in Nigeria averaged 11.5% over the past year whereas interest rates in the US were 2-4%. This leads to massive differences in total interest paid over the course of a 30-year mortgage on a $200k house. The hypothetical borrower in Nigeria pays over $400k in interest whereas the US borrower pays a little more than $100k over 30 years. Wow!

Resolution: Establish digital identities on the blockchain to simplify assessment of credit worthiness. DeFi could be leveraged to expand access to global pools of credit. This could enable credit-worthy individuals and business to developing countries more readily gain access to more and lower-interest financing

Remittances

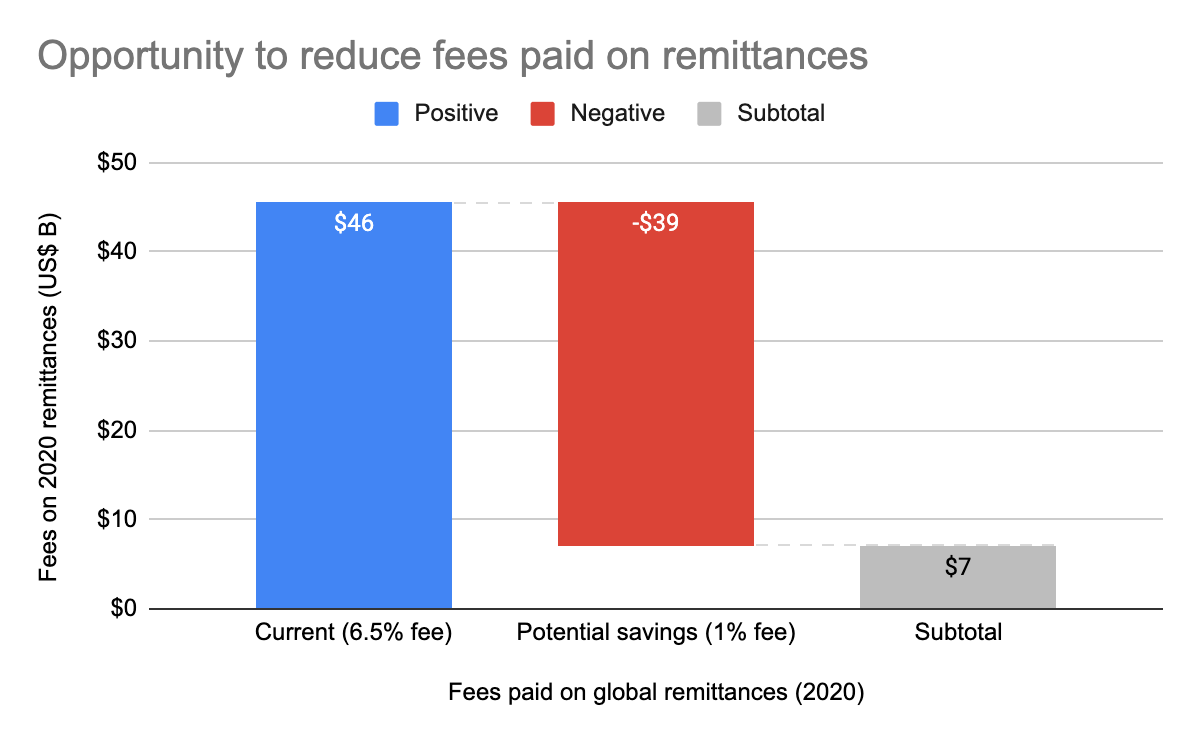

Situation / Complication: Many migrants send a portion of their paychecks home to support family members and invest in businesses. The World Bank estimates that $702B remittances were sent in 2020. In many developing countries, remittances accounted for more than 20% of the GDP. However, the fees associated with these transfers can be exorbitant. The World Bank found the average cost of receiving remittances in Sub-Saharan Africa was 8.2% in Q4 2020. In contrast, domestic funds transfer within the US is FREE using CashApp.

Resolution: Blockchain-enabled cross-border payment solutions are near instant and low cost (<1% fee). Strike.me leverages the Bitcoin Lightning Network to enable users transfer funds funds through their app from US bank account to a foreign bank account. Send Cash Africa achieves similar results too. In contrast, existing bank solutions are more costly and time-intensive. Reducing transaction fees from the global average of 6.5% to 1% could unlock $39B. To put things in perspective, USAID’s annual budget was $40B in 2020.

In conclusion, there are significant opportunities to improve economic prosperity and financial inclusion. I am looking forward to exploring more crypto and blockchain enabled solutions to these challenges. Please let me know if you learn of projects and startups working in this space. I may do a profile on them in the future.

Thanks for joining me this week. Let me know your thoughts. Have a great one.

Share this post