Welcome to the 5x5 Crypto podcast. Each week, we cover the “so what’ of 5 key crypto stories in about 5 minutes. My name is Afo and I’m interested in crypto. I think you’ll enjoy this week’s episode. Like and subscribe on iTunes, Spotify, and Substack. Let’s go!

The 15th of March aka The Ides of March are best known as the day that Julius Caesar was assassinated. What I did not know until recently, is it’s the traditional deadline for Romans to settle their debts. I was thinking about this as I read stories of early bitcoin investors who have paid off mortgages, student loans and basically achieved financial independence. I hope you achieve your goals too.

This week, the news ranges from the bizarre to the thought provoking. Let’s go.

NYC man sells fart for $85

Yes, you heard that right. And frankly, that could have been you.

Alex Ramirez-Mallis, a 36 year old Brooklyn artist and his friends, recorded the sound of their farts every day for a year

They are selling each fart sound as an NFT for $85. Fans are also bidding on the entire year long collection and the highest bid is currently $183.

So what?

So Alex did not originally intend to sell his (sniff) farts. It’s actually kind of a protest. He finds the current NFT craze absurd and is frustrated that the buzz is more about price tags than creativity.

Look, I can see how the current hype could feel like a bubble. The price tags are astronomical and NFTs are everywhere. There are two things to keep in mind

Collectors will always collect. They buy original art pieces then store them behind Matrix like security. Some collectors only care about appreciation. This is not new. This is not going to change. Sorry Alex.

If NFTs were in place 500 years ago, then Leonardo da Vinci and his heirs would have gotten a slice of the pie every time one of his masterpieces was sold. Instead, when a Saudi prince bought one of his paintings for almost $0.5B, all of the spoils went to the collector. NFTs enable creatives to get their fair share. They are here to stay.

Morgan Stanley goes crypto

Morgan Stanley wealth management is enabling its customers to invest in bitcoin

However, it’s only limited to individuals with $2M assets at the bank or corporations with $5M

So what?

This is a big deal because Morgan Stanley is the first major bank to do this. Last week, we talked about how JP Morgan was creating an index to mimic bitcoin exposure. It’s clear that there is demand from clients. Expect more banks to follow suit.

That said, I’m kinda frustrated that it is limited to only high net worth individuals. Many of the best investment opportunities have a high minimum of $100k or more. Whereas you could start with bitcoin with as little as $5. Fortunately, regular folks could get started using CashApp, OKCoin, Swan Bitcoin or one of other options.

Taking a step back, Morgan Stanley has been making steady moves in this direction. Last year, they acquired 10% of MicroStrategy which is one of the largest corporate holders of bitcoin. This weekend, it was rumoured that Morgan Stanley was trying to acquire South Korea’s largest cryptocurrency exchange. Stay tuned.

The promise of decentralized insurance

A study by Accenture found that 65% of insurance executives believe that they must adopt distributed ledger technology in order to remain competitive.

So what?

It is important to keep in mind that there is a lot more to crypto than bitcoin. Decentralized insurance is just one of the many applications that could one day have billions of users.

McKinsey estimates the global insurance industry is valued at about $5 trillion, that’s equivalent to a quarter of the US GDP. The growing middle class in developing countries is driving growth as they seek coverage for their health and property as their purchasing power expands.

The insurance industry is ripe for disruption: payouts are often slow and transparency is limited. Decentralized insurance utilizing smart contracts could expand access, lower costs and speed up payouts.

So who are the winners? It’s still early days. Nexus Mutual is one of the companies to watch. The 3-year old company now has over $300M total value locked. There’s definitely more to come.

Kentucky wants bitcoin mining

Kentucky’s state legislators overwhelmingly voted in favor of passing 2 laws aimed at attracting more bitcoin mining to the state

Miners won’t have to pay 6% sales taxes nor 6% excise taxes on their rigs' electric bills and mining equipment

So what?

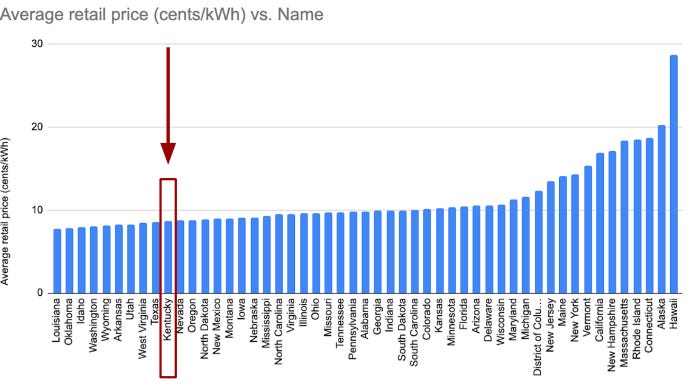

The cost of electricity is the biggest driver of bitcoin mining operating costs. Kentucky already has some of the lowest electricity prices in the country, the tax breaks make it even more attractive.

According to the EIA, 71% of Kentucky’s energy is sourced from coal. An increase in bitcoin mining in Kentucky would likely increase the carbon impact of the cryptocurrency. Hmmnn. Is this what we want to do?

Taking a step back, we have seen an uptick in cities, states and countries competing to lure in tech companies. Amazon’s search for it’s second headquarters and Miami’s ongoing overtures to crypto companies are great examples.

Source: US Energy Information Administration (EIA), November 2020

Watch list: Upcoming crypto IPOs

Coinbase delays IPO to April 2021: direct listing on Nasdaq for the largest US-based crypto exchange with 43M users is expected to be valued at $70-100B

Krakken aiming to IPO in 2022: US-based company is considering a direct listing on Nasdaq in 2022, the crypto exchange has more than 5 million users. Expected to be valued around $10-$20B.

eToro IPO in 2021: Israel-based firm is going public by SPAC IPO, eToro provides customers to purchases stocks and cryptocurrencies through its exchange. Expected to be valued around $10B.

Northern Data AG in 2021: Germany-based company claims to be biggest bitcoin miner. It is considering issuing shares on Nasdaq to raise about $500M