Each week, I cover the “So What?” of 5 stories from the world of crypto in about 5 minutes. Let’s go.

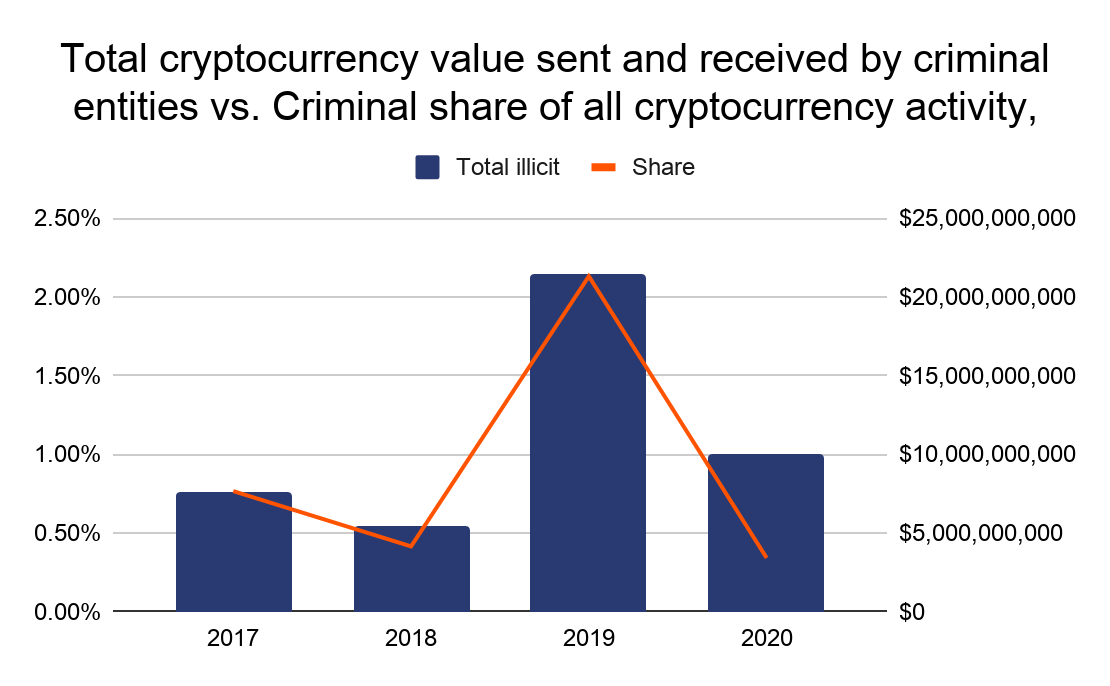

Crypto crime drops to 0.34%

Chainalysis reports total cryptocurrency sent or received by criminals dropped to 0.34% of total in 2020 down from 2% in 2019

In contrast, the United Nations Office on Drugs & Crime estimates money laundering takes up 2-5% of the global GDP each year

So what?

Cryptocurrencies like Bitcoin earned a bad reputation because criminals were amongst its earliest adopters; now it appears that cryptocurrency has a lower share of criminal activity than the traditional fiat payment systems

Scams accounted for 54% of the criminal crypto activity with ransomeware accounting for 7% of crime but increased 311% year-over-year

Firms like Chainalysis partner with the FBI, IRS, DEA, ICE and EuroPol to track the flow of illicit funds along the blockchain; they have identified and seized substantial amounts of money

Source: Chainalysis 2021 Crypto Crime Report

Coinbase has over 43M users:

Coinbase now reports 43+M users across 100+ countries with $90+B assets on the platform

The number of users has increased by 8M (22%) since the last update in mid-2020

Coinbase’s custody business for institutional investors now has $20B assets with $14B received within the past 6 months

So what?

Coinbase is cementing it’s leading position in the cryptoexchange market as interest has grown

Some industry analysts estimate that it’s IPO could fetch $28B or more.

Coinbase could see increased competition for institutional investors as Anchorage recently obtained a federal banking charter and is well positioned to provide sub-custodial services and other crypto-related financial services to large institutions.

New $10B Samsung plant could support US bitcoin mining

Samsung may invest $10B in a 3nm computer chip making facility in Austin, TX

These chips could be used by bitcoin mining operations; however, there could also be demand from the likes of Apple and Nvidia

So what?

China has ~65% of global bitcoin mining capacity while the US and Canada account for ~10% led by 15 mining facilities at scale (>50MW)

China’s dominance is largely due to access to low cost energy after a decade of investing in hydroelectric, coal, and wind energy facilities

Bitmain is building the world’s largest bitcoin mine in West Texas to take advantage of abundant wind energy and deregulated power market; there are couple other large bitcoin mining operations planned or in operation in the Lone Star State

Retail bank develops stablecoin

Sber, the largest retail bank in Russia is developing a stablecoin for use by its corporate clients

The stablecoin will be backed by the Russian Rubble, and could enable low cost, instant payments saving corporate clients high fees

So what?

Sber is the 3rd largest bank in Europe with ~140M retail clients and 1.1 million corporate clients across 22 countries

Sber could eventually apply lessons learned to its retail business

Banks in the US and abroad are receiving regulatory clarity as new guidelines are issued regarding their use of digital currencies; expect more announcements

China is expanding its DCEP pilot

China’s pilot of the Digital Currency and Electronic Payments (DCEP) has netted over 4 million transactions valued more than $300M

It’s now being expanded to Shenzhen where officials will conduct $3M red envelope giveaway

So what?

80% of central banks in major economies are conducting R&D into digital currencies

China’s pilot is one of the most advanced and has morphed from small-scale closed loop to larger-scale open loop tests

Expect rollout beyond China’s Tier 1 cities later this year

Share this post