I periodically do a deeper dive on relevant topics. I am simply sharing my thoughts not offering financial advice. My thoughts are subject to change. I am not a registered financial adviser.

They shuffled around excitedly jabbering on about hash rates and mining pools. It sounded like Greek to me. I had accepted that I may not always be able to keep up with my tech bros. Besides this latest idea sounded intense and risky. The first rule of investing is to invest in what you know. The only rig I knew about was used to produce oil and gas. I resolved within myself to stay away from this harebrained experiment.

Those were my thoughts back in 2016-2017 when my friends were tinkering around with bitcoin mining. Flash forward a couple years and here I am enthusiastically investing and learning about bitcoin and other crypto assets. I have more fully embraced a growth mindset. Better late than never!

The crypto industry has a UI (user interface) problem. Early adopters were highly technical. They built products for other highly technical people...and it showed. Fortunately, it’s been getting easier for lay people off the street to engage with crypto assets. Just as Mt Gox (early clunky crypto exchange) gave way to the likes of Coinbase, could basement mining rigs give way to Compass?

What is Compass?

Compass provides white glove service for customers who want to mine crypto assets like bitcoin but do not want to bother with hosting or maintaining operations. Finally, you could have a machine that “prints” (crypto-) money. One could sign up in less than 10 minutes and sync up your digital wallet to receive payments. There are 3 key steps in the process.

Mining rig: The first step is to select a mining rig. Mining rigs are high powered computers which work to solve a complex math problem. Successfully solving the equation in the allotted time would yield crypto assets. Compass currently has 2 mining rig models to choose from ranging from $5k to $8k each.

Hosting: Next up, select which facility you would like the mining rig to be hosted in. Compass has dozens of facilities from China to Canada and across the US too. The cost of electricity is the biggest operating cost. You definitely want to select a facility that has low electricity costs. Compass’ facilities have access to lower industrial rates ($0.06 per kwh) whereas basement miners pay residential rates ($0.12+ per kwh). It is important to note that Compass charges a monthly fee of $160+ to cover the cost of hosting. This does not include electricity cost. I wonder if there are tax implications for owning mining rigs abroad.

Mining pool: Mining pools are networks of computers who work together to solve the math problem that yields crypto assets like bitcoin. Joining a mining pool increases the odds of solving the equation. Go ahead and join one, just recognize they usually charge 1-4% fee on yields. Slushpool is the oldest one and F2Pool is the largest mining pool. Finally, connect the rig with your crypto wallet and watch the crypto pile up as you sleep.

Is bitcoin mining profitable?

The answer is it depends. Meltem Demirors, a former corporate treasury analyst at ExxonMobil turned investor and Chief Strategy Officer of Coinshares shares the details of her bitcoin mining experience with Compass. Let’s dig in.

Figure 1: Meltem Demiror’s bitcoin mining performance sourced from Twitter

Revenue: Meltem averaged 0.0006 bitcoin mined per day (0.0331 bitcoin / 55 days) from Feb to March 2021. If this holds steady for a year, she would mine 0.22 bitcoins. The value of the yield would vary with the price.

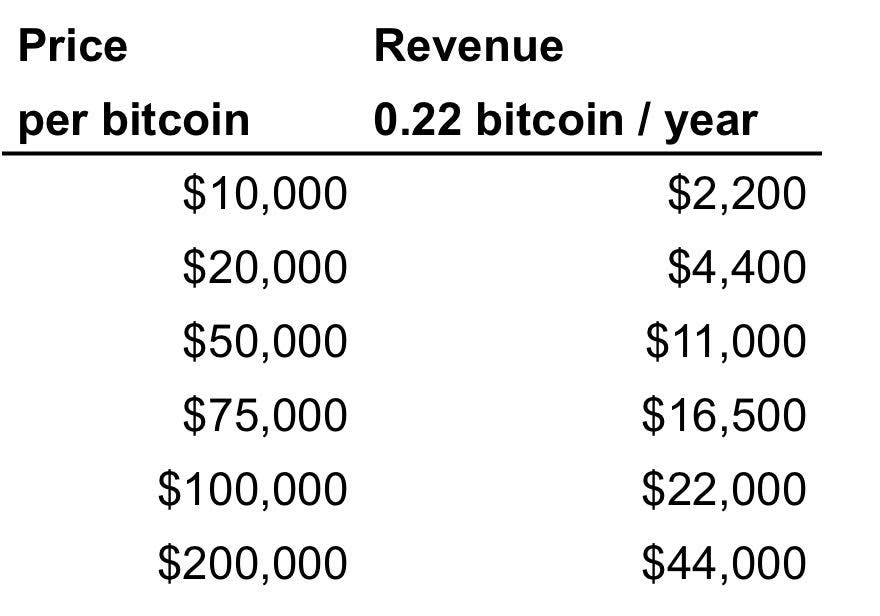

Figure 2: Estimated bitcoin mining yield at different bitcoin prices

At high bitcoin prices, the mining rig pays for itself in less than a year. That said, there is a growing sense that this bitcoin bull market could be drawing to a close. Pantera Capital produces a monthly price outlook for bitcoin. Their forecasts have performed well versus actual. They have a view that the bitcoin bull market could end by December 2021, certainly over before December 2022. Turns out, when you start bitcoin mining could have a significant impact on the payback period.

Figure 3: Monthly bitcoin miner revenue sourced from Glassnode

Bitcoin miners earned a record $1.6B revenue in March 2021 up 5x from September 2020. Monthly revenue is highly variable. It is influenced by the price of bitcoin and size of the reward.

About 18.5 million bitcoin have been mined out of a total 21 million bitcoins available. Every 10 minutes, miners confirm one block of bitcoin transactions. The reward is currently 6.25 bitcoins. Every 4 years, the size of the reward is halved. Therefore, bitcoin mining is expected to continue through 2140. The most recent halvening occurred in May 2020. Miners achieved record revenues despite the halvening because the price of bitcoin increased to sufficiently cover the reduced reward.

Hardware: Meltem is mining bitcoin using a Bitmain S19 mining rig. These are some of the most popular and efficient mining rigs. High demand for mining rigs has run up the price. Computer chip manufacturers simply can’t keep up the pace with demand. This has led to the unusual scenario that the resale value of the mining rig is higher than the initial upfront cost. A flood of new high power mining equipment is estimated to be delivered in November 2021 and January 2022. This may push down the resale value and bitcoin yield.

Costs: There are 3 key sets of costs to bear in mind: electricity costs, hosting fees and mining pool commission.

Electricity: Compass has a range of hosting facilities with access to low-cost electricity prices ($0.04 to 0.065 per kwh). This is more than 50% lower than residential rates in the US. The selection of an energy efficient mining rig and operating system could also help manage consumption. Some miners like Meltem are concerned about the environmental impact of their activity. They choose to offset their carbon impact by buying carbon credits. Carbon credits work by providing lower carbon solutions ex modern cooking stoves for women in India who would otherwise be using firewood. This is an optional additional expense to keep in mind.

Hosting: Compass charges about $160 per month for operating, maintaining and housing your mining rig. Customers sign a 1-year hosting contract.

Mining pool: Participating in a mining pool would significantly increase the odds of earning bitcoin. The cost ranges from 1 to 4% and mining pools have a variety of payout mechanisms.

Verdict

Bitcoin mining is not just about minting bitcoin. It strengthens the bitcoin network. Additionally, becoming a miner is an education in itself. It would push one to dive deeper into the industry. The returns from bitcoin mining are highly variable. Many have argued that it is better to simply purchase bitcoin instead of going through all the hassle. If Meltem had invested $7,500 in bitcoin on February 1st instead of becoming a miner, she would have acquired 0.22 BTC (1 bitcoin = $33k). That purchase would now be worth $13,200 (1 bitcoin = $60k). But this is just a snapshot. Meltem’s set-up provides her with an engine that could churn out 0.22 bitcoins per year. Over the course of 2 years she could earn 0.44 BTC. If you are bullish on the price of bitcoin and have a long-term price target greater than $100k+ then mining might not be an unattractive target (0.44BTC = $44k+ at $100k bitcoin price)

Opportunities

I think Compass has done a great job simplifying the mining process. They are able to reach people who would otherwise not have considered mining. I am not aware of a direct competitor at scale. Increased competition could drive down the hosting fees and increase miner profitability.

The upfront capital required is a stumbling block for some potential customers. I think Compass could take the democratization of mining one step further and let customers purchase fractions of a mining rig. This could lower the barrier of entry and experimentation from $6k mining to $1k. The trouble, however, is that owners would need to be aligned on how to dispose of a mining rig.

I think Compass could also do a better job helping customers understand the tax implications of mining. It would be helpful to understand if there are implications from owning a mining rig outside of the US. Additionally, it would be helpful to understand if customers could write off the mining investment and operating cost. This could change the equation.

Lastly, would-be customers who are not ready to proceed with mining directly could consider investing in publicly traded mining companies like Marathon Patent Group, Riot Blockchain and Hive Blockchain. These stocks tend to move with the price of bitcoin.