Welcome to the 5x5 Crypto podcast. Each week, we cover the “so what’ of 5 key crypto stories in about 5 minutes. My name is Afo and I’m interested in crypto. I think you’ll enjoy this week’s episode. Like and subscribe on iTunes, Spotify, and Substack. Let’s go!

Happy Easter y’all! Q1 2021 is over and we are in a new month. I hope you have been keeping up with your new year resolutions. If you have fallen off the horse, now is a great time to get back on. Last week, I shared that I will be tinkering with the format over the next couple episodes. I appreciate the feedback. Please keep it coming. Let me know why you subscribe and what you are looking to see. Thanks!

This episode includes 5 news stories and a link to help you explore bitcoin mining.

News

Visa to support digital currency payments

Visa became the first payment network to settle transactions on USDC. USDC is a digital currency that is pegged to the value of the dollar. Unlike Bitcoin, the price of USDC is stable (1 USDC = $1), hence the name stablecoin.

What does this mean? Why should I care? Why is this important?

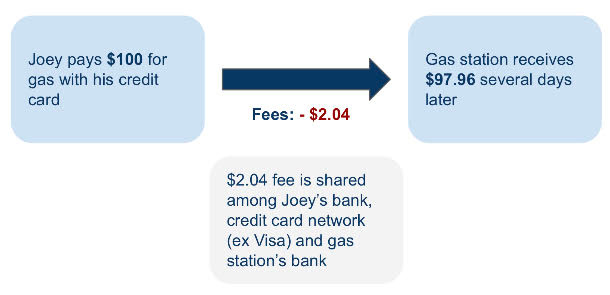

Have you ever wondered why some gas stations offer a discount if you pay with cash instead of card? Well, it is because when you swipe your debit card, it takes several days and dollars before the funds reach the gas station’s bank account.

With USDC, the funds will be transferred near real-time and cost a fraction of a cent. It’s plausible that some merchants could eventually offer discounts to customers who pay with USDC. This is a win-win for the customer and merchant.

USDC will achieve near real-time payments by batching transactions on the Ethereum blockchain.

Figure 1. Illustrates fees associated with a credit card payment

Ether soars to an all-time high (ATH)

This week’s announcement that Visa would utilize Ethereum to settle USDC transactions fueled an 18% rally in the price of ether to ~$2100

Ether has almost tripled this year as deposits in DeFi doubled to $38B in Q1 and new Bitcoin investors explored Ethereum and the suite of applications built on top of it

Coinbase to finally go public on April 14

Lots of retail and institutional investors are prepping funds to go shopping on April 14.

The US largest crypto exchange will directly list 115 million shares. They are expected to price around $350 each which was the average weighted price in the private market in Q1.

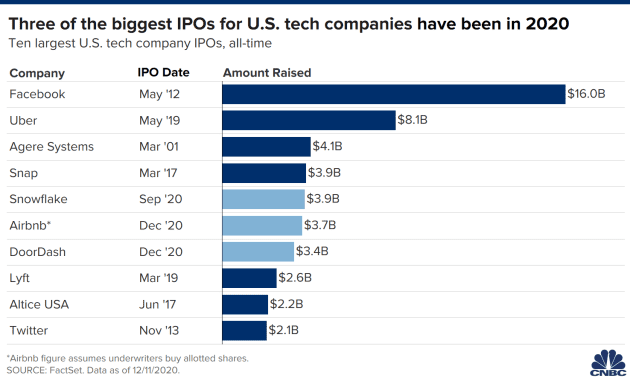

Up to $40B could be raised putting Coinbase valuation up to $100B. This would make the highly anticipated debut one of the largest tech IPOs. Coinbase would be larger than some banking heavyweights like UBS, Barclays and BNP Paribas.

Coinbase will release its Q1 2021 earnings report before the going public. It’s most recent disclosures indicate it had $90B assets under management, over 43 million customers in more than 100 countries.

Figure 2. List of largest tech IPOs (CNBC)

Goldman Sachs goes crypto but don’t hold your breath for the others

Goldman Sachs wealth management to allow high net worth clients invest in bitcoin. This follows Morgan Stanley’s lead two weeks ago.

It’s unlikely that Wells Fargo would follow suit shortly. The bank has been under significant regulatory scrutiny in recent years.

Many retail banks won’t move on crypto until they have to. They are focused on upgrading their dated technology, being compliant with regulators, and keeping up with FinTechs and Neobanks. Some traditional retail banks have not yet put in the work to fully appreciate the promise and challenge of crypto and decentralized finance. They view it as a fad or an experiment waiting to crash

Former Chainalyis exec becomes FinCEN boss

The rise of digital currencies is expected to attract more regulation. There are concerns that some legislators and regulators may not be sufficiently well-versed in these technologies to adequately police and/or support them.

Some of these fears were abated with the recent appointment of Michael Mosier as the head of FinCEN (the US Financial Crimes Enforcement Network). Michael was previously the Chief Technical Counsel of Chainalysis, the leading crypto surveillance firm.

Explore

Bitcoin mining for dummies: Yesterday I dived into Compass, a company which makes it easy for anyone to become a bitcoin miner. I profiled Meltem Demiror’s experience, she used to be a treasury analyst with ExxonMobil but now she is the Chief Strategy Officer at CoinShares. Check it out if you are curious about what bitcoin mining is and the potential returns you could earn. Click here.

I hope you have a great day. Let me know what you think and what you’d like to see.

Ep. 17. Fast & Furious: New Visa payments